HEALTHLOCK FOR MASTERCARD®

AN EXCLUSIVE OFFER FOR HSA/FSA CARDHOLDERS

HealthLock for Mastercard

Stop overpaying for healthcare.

HealthLock Medical Claim Monitor for Mastercard — with no monthly cost

Exclusive Mastercard HSA/FSA cardholder benefit:

Your FSA or HSA helps you save money. But what about overbilling and medical fraud? To help protect you, Mastercard partnered with HealthLock to offer Mastercard cardholders ongoing HealthLock Medical Claim Monitor for Mastercard with no monthly cost.

PLUS for 90 days, cardholders also get a free upgrade to the HealthLock Medical Claim Saver for Mastercard plan, which includes auditing and savings features ($40.47 value). After your 90-day trial, HealthLock Medical Claim Saver does NOT auto-renew, but a payment method is required at sign-up for optional negotiation services.*

What's included:

- 24/7 privacy monitoring of doctors and claims

- Medical data breach and threat alerts

- Medical identity theft remediation**

- Doctor, deductible and claim tracking

- Automatic medical claims review for overbilling

Mastercard cardholders get this exclusive access

To verify your eligibility for this exclusive offer, please enter only the first 8 digits of your Mastercard. This ensures your privacy and doesn’t reveal any of your personal information.

****

****

-

-****-****

Not a Mastercard cardholder? Sign up here. >

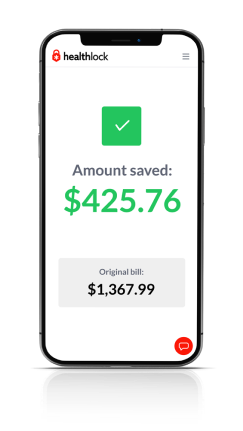

Helps save you money

Review medical claims for overcharges automatically and help get your money back. §

$325

billion

is lost to medical overbilling and fraud1

50%

over

of medical bills contain errors2

Upon joining, we’ll analyze up to two years of your previous medical claims and flag potential overcharges using our HealthLock DeepAudit technology. While in many cases these bills are past the window for negotiation, the analysis helps you identify the potential for future overbilling issues.

For select flagged claims that are less than 90 days old, you can elect to have us work on your behalf to reclaim money from overbilled and overpaid bills.

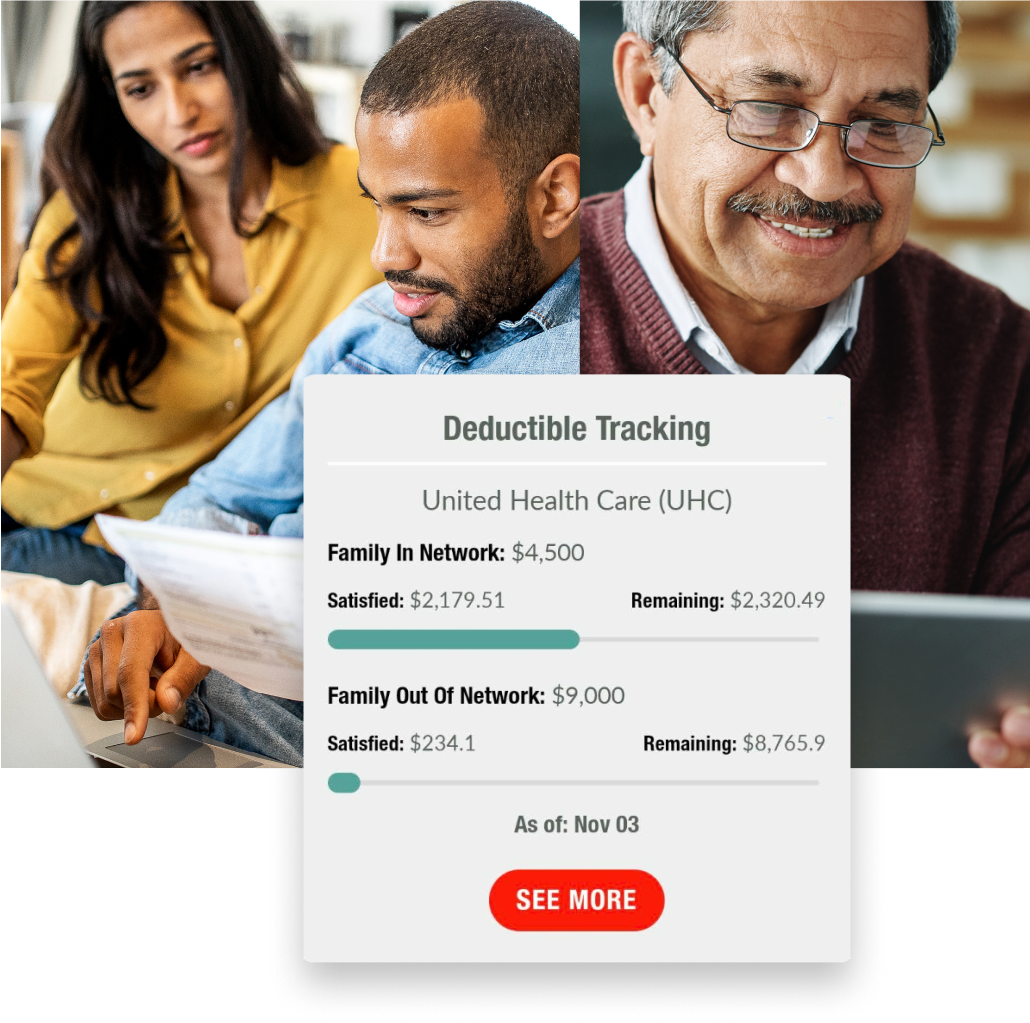

Track what medical expenses you’ve paid out-of-pocket already and know how much you have left to meet your annual deductibles.

If you’ve been overcharged by a provider, you can request that we negotiate on your behalf to help get your money back. To date, we’ve helped our members reclaim over $130 million.

When we negotiate on your behalf, we’ll assign you to a Personal Reimbursement Specialist. While our team is busy getting your money back, they’ll be your single point of contact.

Need help navigating your insurance or healthcare? Our healthcare experts are available to make healthcare easier by answering any questions you might have.

Protects your privacy

Detect medical fraud and guard against privacy intrusions.

59

million

healthcare records breached in 20223

50x more

Your medical data is

valuable than your credit card on the black market4

We alert you by email or text whenever we detect new claims, a breach, or a potential threat. Our comprehensive alerts provide expanded notifications for our enhanced plans to help you stop medical and financial identity theft early.

The only score of its kind, we calculate your privacy exposure based on several risk factors. As the score changes, we alert you via your dashboard so you can take control of your medical privacy.

If you don’t recognize a doctor or your bill doesn’t match, just let us know. We’ll investigate to uncover whether it’s an error or a misuse of your information. If it’s fraud, our team will help fix the problem.

We work around the clock to monitor your providers for HIPAA violations and breaches of your private medical information. If your information is exposed in a breach, we’ll help restore your privacy.

Gives you more control

Organize and track your healthcare claims, providers, and more in one place.

56%

of Americans feel lost trying to understand health insurance5

66%

of bankruptcies are tied to medical issues.6

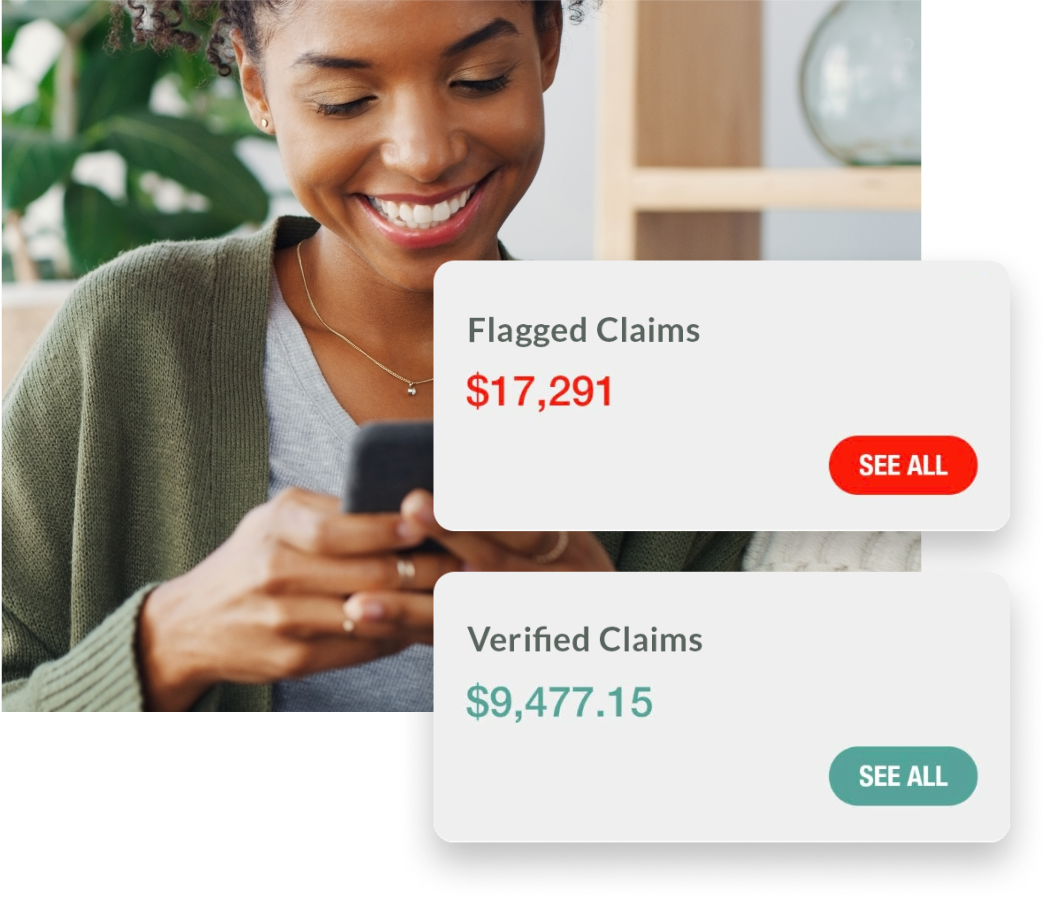

See all your medical claims at a glance. We bring all your insurance-submitted doctor and medical service claims into a single location for easy review and verification.

Have a question? Our friendly team of knowledgeable experts is available via phone, email, or chat to provide advice and answer your questions about alerts, your dashboard, and your membership.

Using our powerful HealthLock DeepAudit Technology, we automatically audit incoming claims and flag potential upcoding and overcharges so you can get your money back.

Take back control of your healthcare with our centralized, easy-to-understand portal. View your claims, deductibles, doctors, and more on your desktop or mobile phone. Securely upload your insurance cards, invoices, and receipts for easy access anytime.

How HealthLock works

Our powerful HealthLock DeepAudit technology and team of ever-vigilant professionals work around the clock to review your medical claims and flag any potential issues like overbilling or fraud.

Sync

Connect your insurance company to HealthLock. We’ll organize your claims, doctors and more in a single secure dashboard.***

Monitor

Our powerful HealthLock DeepAudit technology reviews your claims for errors while we monitor for breaches, new providers and privacy intrusions.

Alert

Anytime we detect potential overbilling, fraud or suspicious activity, we flag it and notify you immediately.

Negotiate

Optionally, you can request HealthLock investigate and negotiate overcharges to get your money back. §

Protect

We work proactively to put your doctors on watch and monitor for breaches 24/7. We always have your back.

"HealthLock negotiated on my behalf. And the insurance paid the whole thing."

"HealthLock manages my medical claims, negotiates with my insurance carriers and providers, and has saved me nearly $100,000 in medical costs."

"I love that HealthLock organizes all of my claims in one place and that they review each one."

Mastercard cardholders get this exclusive access.

To verify your eligibility for this exclusive offer, please enter only the first 8 digits of your Mastercard. This ensures your privacy and doesn’t reveal any of your personal information.

****

****

-

-****-****

Not a Mastercard cardholder? Sign up here. >

* After your 90-day free trial, HealthLock Medical Claim Saver does NOT auto-renew. You can add it for $13.49/month. OR continue with Medical Claim Monitor for Mastercard, yours free as a cardholder benefit.

†Historical Claim Analysis and 90-Day Retro Audit and Recovery are provided once per member lifetime only during initial enrollment.

§Negotiation and recovery services require 20% shared savings of reclaimed money or bill reduction, charged to the payment option on file upon confirmation of recovery from the carrier or provide.

Program Description

HealthLock is an end-to-end analytics-driven platform that helps protect cardholders’ medical identities and data, and monitors their medical claims for errors, fraud, and overbilling. HealthLock provides three plan levels:

- Medical Claim Monitor: Helps guard against medical fraud and privacy intrusions by monitoring medical data breaches, providing alerts, and helping remediate medical fraud issues.

- Medical Claim Auditor: Organizes, tracks, and audits all healthcare bills (24-month retroactive audit and ongoing auditing) in one place, verifying that all bills are accurate and identifying potential overcharges and insurance errors. This level includes everything from the previous plan level.

- Medical Claim Saver: Provides access to medical bill negotiation with providers and insurance companies to potentially help reduce bills and reverse claim rejections. This level includes everything from the previous plan levels.

Enrolled users receive, at no cost, Medical Claim Monitor, plus a premium upgrade to Medical Claim Saver for the first 90 days. After 90 days, users will continue to receive Medical Claim Monitor at no monthly cost and have the option to continue with Medical Claim Auditor service for $4.99 per month, or Medical Claim Saver for $13.49 per month.

Additional Terms

HealthLock is a third-party service provided directly to cardholders by InsuranceAssist, Inc., a California Corporation d/b/a HeathLock, with offices at 3480 Torrance Blvd., Los Angeles, CA 90503 (InsuranceAssist). As such, Mastercard takes no responsibility, and makes no warranties or representations, whatsoever for/ in respect of any aspect of the HealthLock service. All rights of recourse for any compensation for any failure or deficiency of the HealthLock service are between the cardholder and InsuranceAssist. Except as otherwise required under applicable law, Mastercard disclaims all liability for any and all losses, claims or liabilities which may arise in connection with the provision of the HealthLock service.

InsuranceAssist obtains the data required to provide the HealthLock service directly from the cardholder’s healthcare insurance carrier/administrator, with the cardholder’s consent. Mastercard is not involved in that flow of data and does not process any cardholder’s personally identifiable information (PII) or protected health information (PHI) in connection with the HealthLock service.

InsuranceAssist has responsibility for ensuring that all data protection/ privacy concerns are addressed and all data protection and privacy laws are complied with in connection with the provision of the HealthLock service. This includes ensuring that all requirements of the Health Insurance Portability and Accountability Act (HIPAA), including the applicable security standards, are met.

1JAMA Networks, 2Healthline, 3Protenus, 4Experian, 5Bend HSA, 6American Journal of Public Health

Eligibility:

HealthLock for Mastercard is a benefit available for all U.S. Mastercard cardholders and all U.S. Mastercard HSA/FSA cardholders, excluding any cards issued by a U.S. government agency (federal, state, county or city). Eligible cardholders must reside in the United States and have a United States Health Insurance carrier to participate. By participating, you agree to these terms and HealthLock’s Terms of Service (https://healthlock.com/terms-and-conditions/). Cardholders can live chat within the application on the HealthLock website or they can submit an email inquiry to support.mc@healthlock.com. Alternatively, they can also call the customer service line at 833-356-2331, Monday through Friday between 7:00am and 7:00pm CST, or via online chat, available Monday through Friday between 8:00am and 6:00pm CST. All rights reserved.